BASF

is a chemical company. It was founded in the middle of 1865 in the city of

Ludwigshafen, Rhineland-Palatinate, by Friedrich Engelhorn to produce inks. It

is the largest chemical company in the world, surpassing Dow Chemical Company

and DuPont. BASF increased its sales by 11.1%, up to 87,300 million euros in

2022

Its

main factory, still located in the city of origin of the company

(Ludwigshafen), has become the largest integrated chemical enclosure in the

world, with a surface area of 10 square kilometers. The production center comprises

2,000 buildings, 115 kilometers of streets, and approximately 211 kilometers of

railways, where more than 39,000 employees are employed.

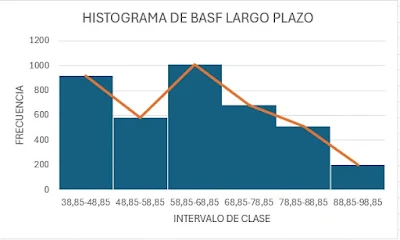

The study of BASF began on January 4, 2010, and

continued until June 18, 2025. During this period, the long-term profitability

was negative at -5.86%. With a mean of 63.60, a median of 64.44, and a mode of

66.66.

The difference between these position statistics

shows a rightward skew and a flatter-than-normal kurtosis.

The chart analysis shows a downward trend with a

negative slope. The equation of the least squares line is Y = -0.0042x +

71.882, and the coefficient of determination (R2) = 0.1058. This is low,

suggesting that the linear model explains only a small portion of price

variability, indicating the presence of other factors and non-purely linear

behavior. In addition, two polynomial trend curves were plotted to establish

the duration of market cycles. To do

this, a green 6th-order polynomial was drawn, which explains 71.63%. Often, when plotting the 6th-order polynomial, it is

greatly influenced by small variations due to its sensitivity. To avoid this,

we draw a 3rd order polynomial that presents a more moderate behavior, giving

an R2 = 69.74%.

The cycle has a duration of

3.9 years in the prosperity phase. The deformation coefficient of 0.1994 is

positive, indicating a rightward deformation. The difference between resistance

and support is 58.82, implying a considerable range of fluctuations for the

stock price over the long term. The cumulative probability p = 7.15%, which in

the context of support and resistance could indicate low confidence in the

persistence of certain price levels or intrinsic weakness in the recovery from

lows. This shows little confidence because the cumulative probability shows a

low value.

The forecast for the next half

year is €54.34, which is significantly below the historical average for the

period, reinforcing the expectation of a continuation of the downward trend.

In the medium term, the BASF

study began on March 3, 2021, and runs through June 18, 2025. Over this period

of the last three years, the long-term profitability achieved was negative at

-40.85%, with a mean of 50.85, a median of 47.44, and a mode of 67.08, similar

to the long term, but now further from the mean and median, suggesting that

high prices are less frequent during this period. The difference between these

statistics continues to show a right skew, and the kurtosis is flatter than the

normal (platykurtic), indicating a distribution with lighter tails, albeit with

a steeper decline in average prices. The

difference between these position statistics shows a right skew and a flatter

kurtosis than the normal.

The downward trend with a negative slope is more

pronounced, with an equation of the least squares line Y = − 0.0213 x + 62.63.

The R2 = 0.5552 is significantly higher than in the long run, indicating that

the linear trend explains a greater proportion of price variability in this

more recent period. In addition, two polynomial trend curves were drawn to

establish the duration of the market cycles. To do this, a green 6th-order polynomial was drawn that

explains 83.36%. On many occasions, when the 6th order polynomial is drawn, it

is greatly influenced by small variations due to its sensitivity; to avoid

this, we drew a 3rd order polynomial that exhibits moderate behavior, giving an

R2 = 80.31%. The prosperity phase

of the cycle is shorter, lasting 1.54 years. This

suggests faster or less sustainable market cycles in this recent period.

The distortion coefficient of 0.9989 is positive,

indicating a rightward distortion. The difference between resistance and

support is 33.76. This range of fluctuations is narrower than in the long term,

which could indicate lower absolute volatility in this recent period, but

within a downtrend. The cumulative probability p = 16.34% remains low,

suggesting low confidence in the recovery or stability at low levels,

indicating low confidence.

The forecast for the next quarter is €37.38,

reinforcing the expectation of a continued decline and well below the average

for the period.

In the short term, the BASF study ran from September

27, 2024, to June 18, 2025. Over this period, the short-term profitability

achieved was negative by -12.84%, with a mean of €45.24, a median of €44.60,

and a mode of €42.42. Over this period, the mode is lower than the mean and

median, which, together with the difference between the statistics, indicates a

right skew. The kurtosis is steeper than the normal (leptokurtic) kurtosis,

suggesting that, despite the downward trend, there has been a higher frequency

of more extreme price movements (positive or negative) compared to a normal

distribution.

The linear downward trend is less pronounced, with

the equation Y = − 0.0072 x + 45.945. The R2 = 0.0164 is extremely low,

indicating that linear regression explains a negligible proportion of the

short-term variability in the stock price. This suggests that short-term price

movement is highly erratic or dominated by noise, and a simple linear trend is

not adequate. Two polynomial trend curves were also plotted to establish the

duration of market cycles. To do

this, a 6th-order polynomial, colored green, was plotted, explaining 64.35%.

Often, when plotting the 6-point polynomial, it is heavily influenced by small

variations, which is called overfitting due to its sensitivity to extreme

values. To avoid this, we plot

a 3rd-order polynomial, which exhibits moderate behavior, giving an R2 =

34.60%. The prosperity phase of the cycle is very short, 58 days, which

underscores the rapid reversal or lack of sustainability of short-term bullish

movements.

The distortion coefficient of 0.8361 is positive,

indicating that the distortion is to the right. The difference between

resistance and support is 14.83. The cumulative probability p = 15.81% shows

little confidence, because the cumulative probability shows a low value.

The forecast for the next half year is €43.65, also

below the period average, confirming the expectation of continued downward

pressure.

BASF's stock performance exhibits a clear and

sustained downward trend across all time horizons, with an acceleration in the

average price decline and negative returns in the medium term.

The consistent decline in the mean and median price

as the time horizon shortens, from €63.60 in the long term to €45.24 in the

short term, is an unequivocal sign of a structural deterioration in market

perception of BASF. The negative returns across all periods, especially the

-40.85% in the medium term, highlight a prolonged and significant bearish

phase.

The standard deviation decreases from the long to the

medium term, from 14.69 to 9.04, which could indicate a consolidation phase or

price stagnation within the downtrend. However, the leptokurtic kurtosis in the

short term suggests that, while the range may be narrower, sudden (extreme)

movements are more likely. The range between resistance and support has also

narrowed in the short term, reflecting a smaller range of movement.

The trend has remained at similar levels in the long

and medium term, around €66-€67, but it is notable that in the short term,

€42.42 has become more aligned with current prices. This could indicate that

previously "frequent" price levels are now resistance points, and

that current prices are consolidating in a lower range. The positive right skew

in the price distribution across all periods suggests that, although prices

have declined, the distribution has a longer tail toward higher prices, which

could reflect occasional rebound spikes that are not sustained.

Forecasts for the next half year are consistently

below the respective means for each period: €54.34 for LP, €37.38 for MP, and

€43.65 for CP, indicating a widespread expectation of continued deterioration

or at least a downward trend.

The lower volatility in the medium term and the

narrow range in the short term, combined with bearish forecasts, may suggest

that the market has already priced in much of the bad news but lacks clear

catalysts for a reversal.

The low R2 values in the linear regression for the

long and short terms, 0.1058 and 0.0164 respectively, indicate that the linear

trend is a poor predictor of price behavior. Polynomial trends, especially the

third-order trend with higher R2 values of 70-80% in the long-term/long-term,

are more effective at capturing cycles, but even so, a short-term R2 of 34.60%

for the third-order polynomial suggests high unpredictability.

For a complete understanding of BASF's downward

trend, it is crucial to complement this quantitative analysis with a

qualitative study of external and fundamental factors:

As an energy-intensive chemical company, BASF is

highly vulnerable to volatile energy prices, especially natural gas, in Europe.

The high inflation environment and rising global interest rates can affect

chemical demand, financing costs, and the purchasing power of end consumers. A

global or regional economic slowdown directly impacts chemical demand in

various industries (automotive, construction, consumer goods).

Decarbonization and sustainability policies in the EU

can impose significant costs on BASF in terms of investments in new

technologies and regulatory compliance.

Carbon taxes and emission permits directly affect the

cost structure.

The Russia-Ukraine conflict impacts the supply of

energy and raw materials, and strains global supply chains. International trade

policy has generated potential tariff barriers or trade disputes affecting

BASF's exports. Global overcapacity is leading the chemical industry to suffer

from overcapacity, which puts pressure on prices and margins. Quantitative

analysis of BASF's historical stock performance reveals a clear and sustained

downward trend across all time horizons, with negative returns and forecasts

suggesting a continuation of this downward pressure. Low confidence in support

levels and the erratic nature of short-term price movements, evidenced by the

low R2 of linear regressions, complicate the identification of inflection

points.